On April 2, Trump announced the imposition of a 10% “base tariff” on nearly all countries and “reciprocal tariffs” on more than 60 “violating” countries and regions, launching a global tariff war. His aim is to attempt to abolish the current free trade system framed by the WTO and rebuild a trade system that is beneficial to and dominated by the United States.

1. The Global Free Trade System Has Become an Unbearable Burden for the United States

The current global trade system originated from the General Agreement on Tariffs and Trade (GATT), which was established under U.S. leadership in 1948. At that time, U.S. manufacturing accounted for 60% of the world's total manufacturing output, making it the largest exporter, with international payments anchored to gold (the gold standard). From 1946 to 1952, the United States had an average annual export surplus of up to $2 billion. Clearly, GATT was beneficial to the U.S.

However, as industrialized nations such as Europe and Japan recovered their post-war economies, the U.S. began running a $1.5 billion trade deficit in 1971. Meanwhile, deeply entrenched in the Vietnam War quagmire, the U.S. faced huge fiscal deficits. To address the fiscal crisis, the Nixon administration at the time “reneged” on its obligations by unilaterally abandoning the gold standard, while forcing ten countries including Germany, France, the U.K., and Japan (the G10, or Group of Ten) to sign the Smithsonian Agreement. This compelled the G10 currencies to appreciate, corresponding to a sharp 10% devaluation of the U.S. dollar—and thus established the hegemony of the dollar.

Yet dollar hegemony led to a surge in the U.S. trade deficit, which reached $148.5 billion by 1985, with $50 billion stemming from trade with Japan. As a result, the Reagan administration repeated the same tactic, pressuring Japan to sign the Plaza Accord, which caused the Japanese yen to appreciate by nearly 100% overnight. This failed, however, to stem the trend of U.S. manufacturing outsourcing and the soaring trade deficit.

By the end of the Cold War, the share of manufacturing in U.S. GDP had declined from 24.5% in 1971 to 14% in 1992, while the trade deficit skyrocketed to $290.4 billion. To tackle this situation, the Clinton administration, leveraging established U.S. hegemony, vigorously promoted the expansion of GATT, leading to the establishment of the World Trade Organization (WTO) in January 1995. Compared with GATT, the WTO added provisions highly beneficial to the U.S. in services and intellectual property protection, forming a global free trade system aligned with Clinton’s “globalist” strategy.

Bill Clinton and “globalist” strategists firmly believed that this system could ensure the United States enjoyed the enormous dividends of dollar hegemony while effectively controlling the resulting trade deficits. At the time, Hillary Clinton assured members of Congress that “Americans will never have to repay debts.” This was not because the U.S. could print money without limit, but because the free trade system could channel dollars flowing to the world through free trade back to the U.S. via four mechanisms, forming a “perpetual motion machine” that allowed America to profit.

First, leveraging the credibility of dollar hegemony to issue U.S. Treasury bonds. Countries (especially surplus nations) could not only earn fixed returns by purchasing U.S. bonds but also maintain the high liquidity of their “wealth.”

Second, the U.S. held overwhelming advantages in services such as financing, credit, bonds, insurance, consulting, and law, as well as in R&D, design, and manufacturing of high-end products (intellectual property), enabling it to capture the richest gains from economic globalization.

Third, manipulating U.S. dollar interest rates to create a “dollar tide” that harvested wealth from other countries—the 1997-1998 Asian financial crisis was a classic example.

Fourth, monopolizing the military products market.

Following the Cold War, the United States further expanded its global security alliance system, institutionally securing its military-industrial market. The “generational leap” advantage demonstrated by American weaponry during the first Gulf War further fueled massive global sales of US arms. Indeed, this free trade system initially brought the US enormous profits. The Clinton administration (1993-2000) became the only US government since the Cold War to achieve a fiscal surplus.

However, the unfolding of economic globalization-particularly China’s rapid development-fundamentally undermined the US profit model within the global trading system.

Firstly, the globalization of capital led to a continuous flow of dollar capital from developed nations to developing countries seeking optimal resource allocation. This, in turn, drove the globalization of manufacturing (supply chains), resulting in a continuous flow of finished goods from developing to developed nations seeking profit maximization. The consequences were twofold: On one hand, credit capital employed various “innovative” methods to increase leverage for exorbitant profits, while expanding budget deficits caused the US national debt to surge from $4.974 trillion in 1995 to $10 trillion in 2008, subsequently skyrocketing to $36.6 trillion today. While “Americans never need to repay the principal,” they must service the interest-today, the $1.2 trillion annual debt interest payment constitutes the largest US expenditure. On the other hand, developing nations, led by China, saw their foreign exchange reserves continuously expand. Of the current global foreign exchange reserves totaling $12.8 trillion, the BRICS nations alone hold nearly $8 trillion. The massive holdings of dollar reserves and US Treasury bonds by other countries have become a “ticking time bomb” threatening the credibility of the US dollar.

Secondly, China's swift development has consistently broken the US monopoly on high-end technologies. At the beginning of this century, the West, led by the US, promoted an environmental “political correctness,” attempting to regulate-and essentially constrain-the industrialization process of developing nations through overly stringent energy consumption requirements, thereby solidifying their own developed status. However, China, pursuing its own sustainable development, forged a new path in the new energy sector, establishing an unshakeable advantage. Facing various US blockades in high-tech fields, especially in semiconductors, China also rapidly achieved breakthroughs, establishing a “high-quality” development trend led by artificial intelligence and new energy.

Thirdly, China’s adherence to a socialist market economy and its firm defense of its financial sovereignty have made it difficult for “dollar flooding” to exploit China. During the 1997-1998 Asian Financial Crisis, US capital ruthlessly exploited Asian nations but was defeated in Hong Kong, which had just returned to China. The establishment of the EU single market and the launch of the Euro also built a levee against dollar flooding. (In this sense, Trump’s statement that “the EU was formed to destroy the US” holds a degree of truth.) During the 2008 Financial Crisis, the US instead needed China’s help to weather the storm. The establishment of the Asian Infrastructure Investment Bank (AIIB) in 2016 fundamentally strengthened China’s autonomy within the dollar hegemony system, making its defenses against dollar flooding even more impenetrable.

Finally, despite US and Western arms embargoes on China since the 1990s, China has relied on its own efforts to not only modernize its entire military-industrial system (surpassing the US in some critical areas) but also begun exporting to traditional US defense markets. Countries like Saudi Arabia and Pakistan are now purchasing large quantities of high-quality, cost-effective Chinese military equipment. Meanwhile, due to the hollowing out of US manufacturing and industry monopolies, the US military-industrial system has become increasingly corrupt and inefficient, struggling even to meet its own domestic weapons demands, let alone supply the global market.

Thus, within a global free trade system originally designed, promoted, maintained, and refined by the US to serve its own best interests, all US profit mechanisms, save for dollar hegemony, have become unsustainable. Wall Street has become the US’s only remaining profit engine, growing distortedly dominant within the US economy. Its side effects are the continued hollowing out of the real economy and the relentless erosion of dollar credibility, accompanied by uncontrollable debt.

2. The Real Attempt of Trump's Global Tariff War Is to Establish a New Trade System Dominated by the United States

In fact, as early as Obama’s second term (2012-2016), the United States had already found the WTO framework increasingly burdensome. Consequently, it actively pushed for the Trans-Pacific Partnership (TPP) and the Transatlantic Trade and Investment Partnership (TTIP), attempting to establish new economic and trade orders in these two crucial economic regions. The aim was to contain China’s development while simultaneously dominating the European economy. This represented the final effort of the “globalist” strategy in the economic and trade sphere, but it ultimately failed. The Biden administration merely issued an executive order for the largely symbolic Indo-Pacific Economic Framework (IPEF), whose policy momentum vanished with personnel changes. Upon his return to the White House, Trump completely discarded diplomatic niceties and launched tariff wars against the world.

Firstly, tariff wars cannot revitalize American manufacturing. Even if countries scale back manufacturing under high tariff pressure, or even if—as Trump hopes—they bring their own capital, equipment, and supply chains to invest and set up factories in the US, today’s America lacks sufficient engineers, skilled industrial workers, and crucially, the necessary industrial ecosystem for manufacturing. Moreover, maintaining dollar hegemony and reshoring manufacturing constitutes a structural paradox—a well-established consensus in economics. Since the establishment of the dollar hegemony in the 1970s, the share of manufacturing in the US economy has continuously declined. Despite the efforts of both President Trump (first term) and President Biden to revive US manufacturing, its share still fell from 11.2% in 2017 to 9.8% in 2024.

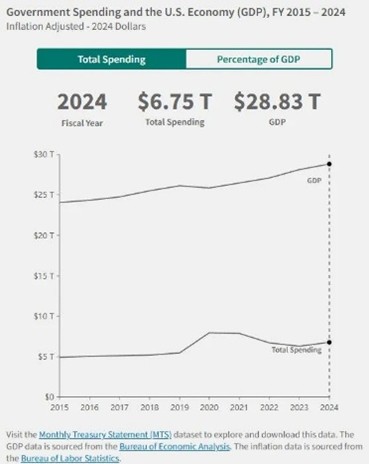

Secondly, tariff wars cannot “make America rich again.” According to data released by the US Treasury Department,[1] federal spending for 2025 is projected to increase by 13% compared to 2024, reaching $7.63 trillion, with a deficit constituting a staggering 38% of that, amounting to $2.9 trillion. Based on the FY2025 budget resolution passed by the US Senate on April 5th, extending Trump’s 2017 tax cuts would reduce federal revenue by $3.8 to $4.5 trillion between 2025 and 2034. This means that even if the US economy maintains a 2% annual growth rate over the next decade, federal revenues would only range between $4.7 trillion and $5.5 trillion per fiscal year.

Figure 1 Government Spending and U.S. Economy (GDP) from Fiscal Year 2015 to Fiscal Year 2024. For Fiscal Year 2024, the total U.S. government spending was $6.75 trillion, and the GDP was $28.83 trillion. The data was last updated in September 2024 by Fiscal Data

If Trump’s fiscal plan is implemented, the US government would need to collect a staggering $3.2 to $4 trillion in tariffs annually to fill the projected average budget deficit of 35% or higher. However, US tariff revenue in 2024 was only $82.9 billion. Even under Trump’s proposed “reciprocal tariffs,” increasing tariff revenue by 30 to 40 times is unimaginable. High tariffs cannot even plug the hole in the US budget deficit, let alone “make America rich again.”

Finally, there is the so-called “Mar-a-Lago Agreement,” stemming from a report titled “A User’s Guide to Restructuring the Global Trading System” by Stephen Miran, Chairman of Trump’s Council of Economic Advisers.

According to Miran’s report, Trump’s global tariff war would subject the world—especially China—to immense pressure, potentially triggering a major economic recession. This would allegedly force countries to accept ultra-long-term US century bonds, lower interest rates on US debt, significantly devalue the dollar, and prompt manufacturing powers to invest heavily in the US, even writing checks directly to the US Treasury. However, leaving aside the report’s arrogance, paranoia, ignorance, and wishful thinking, if a tariff war did cause a major recession, the US economy and Trump’s political survival would be the first casualties.

Trump is reckless, but not foolish. Slogans like revitalizing US manufacturing through high tariffs or “making America rich again” are merely populist rhetoric used to legitimize his policies. The true objective of Trump’s global tariff war is to fundamentally alter the world’s trading system and rules. Because Trump and his followers believe that the free trade system established and led by the US since WWII has evolved from benefiting America to harming it. The “globalist” strategy of liberal internationalism is seen as a key factor in America’s perceived “decline.”

Therefore, Trump’s global tariff war aims to bypass the multilateral trade system, forcing countries into one-on-one bilateral negotiations with the US. Trump unabashedly declares high tariffs as his “leverage,” intended to pressure nations into agreeing to bilateral trade deals favorable to the US. This would reshape a global trading system “in America’s terms and in America’s favor,” thereby “making America great again.”

Clearly, Trump’s ultimate goal is to compel China to submit. The US and China account for 18.5% and 16.4% respectively of the $33 trillion global trade, with Europe, East Asia, Southeast Asia, and North America making up the remaining 55%. Countries like India and Vietnam have already compromised with the US, while Japan and South Korea show signs of leaning towards compromise. In Trump’s view, securing bilateral trade deals with nations across these regions would allow him to erect trade barriers against China worldwide, forcing it into submission.

3. The Only Viable Path out of Trump’s Tariff Policies: Pursuing Dialogue and Cooperation with China

However, Trump’s global tariff war is destined to fail.

First, China refuses to yield and meets force with force. Faced with Trump’s bullying, devoid of any credibility, compromise or concession would only invite further aggression. Therefore, in response to Trump’s escalating tariffs, the Chinese government not only imposed equivalent tariffs on U.S. imports but also delivered powerful countermeasures, including restrictions on raw material supplies, control over industrial chains, and sanctions against U.S. companies abetting his agenda. More importantly, China implemented comprehensive plans emphasizing that “forging iron requires greater self-reliance.”

On one hand, the government rolled out unprecedented proactive fiscal policies to ensure the stable development of China’s economy, demonstrating particular resolve and confidence in stabilizing capital markets. As the world’s largest manufacturing and trading nation, China’s economy is deeply integrated into the global economic and trade system. As long as China stands firm, any attempt to establish a self-serving global trade system will inevitably fail.

Second, China has demonstrated its responsibility as a major power on a broader strategic scale. Following Trump’s return to power, China showcased its resolve, confidence, capability, and responsibility to “never allow turmoil in the Asia-Pacific” through a series of military exercises and weapons tests flexing its military muscle. After all, the Asia-Pacific region accounts for 61% of the world’s population, 56% of its economy, and 70% of global economic growth. As long as the Asia-Pacific maintains stable development, China remains invincible.

Third, U.S. economic circles and mainstream media unanimously agree that Trump’s bullying tariff war will inevitably trigger a new wave of the “three highs”—high inflation, high deficits (debt), and high (financial) panic—resulting in a severe economic recession, or even a depression. Shortly after Trump launched his global tariff war, Wall Street stocks plummeted consecutively, while U.S. Treasury yields surged sharply. This indicates that the stock crash forced major funds holding U.S. bonds to sell them to cover losses, while banks were compelled to liquidate client-pledged bonds used as collateral for stock purchases to cut losses. Confronted with an imminent financial meltdown, Trump had no choice but to retreat, announcing a 90-day “pause” on the high-tariff policy. Following this pause, Wall Street rebounded sharply—clear proof that the tariff war spells disaster for the U.S. economy.

Nonetheless, the trend of “simultaneous stock, bond, and currency market crashes” in the U.S. economy remains difficult to reverse, with massive capital flight from Wall Street now an undeniable fact. Clearly, if Trump obstinately persists with his tariff war, it will bring catastrophic consequences to an already fragile U.S. economy.

Fourth, China’s firm resistance against U.S. bullying has gained widespread support. Some Western media falsely claim that China stands “alone plus one” in the tariff war, isolated and without allies. Trump also boasted that over 70 countries had called to “kowtow,” begging to surrender. Yet only a handful of nations approached him seeking compromise, and capitulators including Israel were publicly humiliated, receiving no concessions from Trump. Meanwhile, U.S. neighbors and closest allies—Canada and the EU—have adopted tough stances and retaliatory measures.

In reality, no country supports Trump’s tariff war; even those appearing conciliatory act out of necessity. The tariff war has shattered America’s credibility and responsibility, leaving it isolated and unjust. Amid a world both weary of U.S. dominance and intimidated by it, China courageously shoulders its responsibility by raising the banner of resistance—a just cause that commands broad support. After all, what China resolutely defends is not only its own vital interests but also the global free trade system, which benefits all nations and operates through multilateral frameworks.

Finally, Trump’s greatest vulnerability is time. With the 2026 congressional elections approaching, America’s irreconcilable divisions and extreme political polarization force Trump to deliver “results” before the fall campaign season begins.

Currently, his high-stakes “peace plan” for Ukraine has stalled. Should the tariff war drag into the latter half of the year without yielding results, Trump faces total collapse. If his deeply resentful Democratic opponents regain control of Congress in 2026, not only will his administration become a lame duck, but Trump and his family risk utter ruin. The “insider trading” scandal alone—where his family profited at least $25 trillion during the April 10 stock rebound—could land Trump and his relatives in prison. After launching the tariff war, Trump repeatedly declared he was “waiting for China’s call,” claiming he would deal with China “graciously” if negotiations occurred—a clear display of bluster masking weakness.

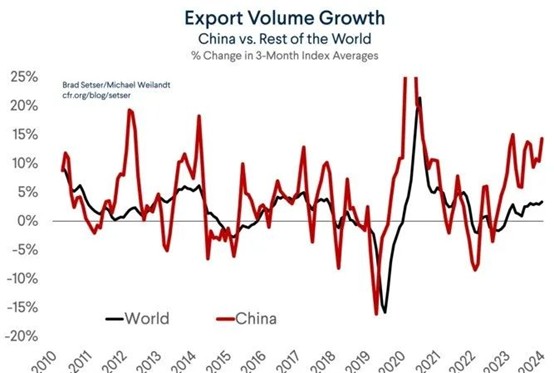

Recent research by U.S. economist Brad Setser [2] reveals an unshakeable duality between America, the world’s largest currency issuer (buyer), and China, its largest manufacturer (seller): the former holds a $920 billion trade deficit, the latter a $990 billion surplus.

Figure 2 Comparison of export growth rates between China and the rest of the world (excluding China) from December 2010 to December 2024. The red line represents China, and the black line represents the rest of the world

Following the first round of Trump’s “trade war” in 2018, China’s exports to the U.S. dropped significantly. However, the lost market share was largely filled by increased exports to the U.S. from five economies: ASEAN, Mexico, South Korea, India, and Taiwan, China. Simultaneously, China’s exports to these economies grew in lockstep with their rising exports to America. Setser’s research reveals two critical insights: First, due to the hegemony of the U.S. dollar, America acts as the world’s “ultimate order-placer,” while manufacturing powerhouse China serves as the “ultimate order-taker.” Second, economic globalization enhances production efficiency, reduces transaction costs, and expands choices for both parties: order-placers select quality and price, while order-takers prioritize efficiency and profits. Tariffs, however, create a lose-lose scenario, negatively impacting quality, pricing, efficiency, and profitability.

In an escalating tariff war, the order-placer will inevitably collapse first, because once circulation stalls, currency becomes worthless—after all, money cannot be eaten.

Clearly, Trump’s global tariff war has reached a dead end, leaving compromise and cooperation with China as the only viable exit. China’s door for collaboration remains open. Indeed, tangible common interests bind China and the U.S., with safeguarding global financial stability now the most urgent priority. Trump’s obstinate trade war has pushed the world to the brink of a crisis exceeding the 2008 financial meltdown. Should the financial order crumble, it would unleash catastrophic economic, political, social, and even security consequences worldwide—especially for America.

Thus, Sino-U.S. cooperation to stabilize the global financial order is not merely a starting point—it is the pivotal point.

Notes:

[1]Reference:https://fiscaldata.treasury.gov/americas-finance-guide/federal-spending/

[2]Brad Setser, “The Evolution of Global Trade in 2024”, https://www.cfr.org/blog/evolution-global-trade-2024

Author | Huang Jing, Distinguished Professor at Shanghai International Studies University and Director of the Institute for American and Pacific Studies, Shanghai Academy of Global Governance and Area Studies

Source | “Bottom Line Thinking” WeChat Public Account, April 19, 2025.

Translated and reviewed by Yan Shuai with AI translator